mars

11 May 2021 19:52

1

Today I had a call with a specialized legal firm:

I don’t want to reinvent the wheel.

What is the copy-paste legal structure?

This book has some legal templates:

Founding Startup Societies: A Step by Step Guide eBook : Frazier, Mark, McKinney, Joseph : Amazon.co.uk: Books

You can assume I’m forward-thinking and open-minded and my genuine intention is to maximize participation.

chris

11 May 2021 20:02

2

You are considering using a UK legal structure for a co-op that will be based in Estonia?

mars

11 May 2021 20:28

3

Maybe.

There is a member in my community that is pushing towards co-op structure.

So I’m thinking - let’s explore options.

I like “asset lock” - a feature of CIC (community interest company)

I like “self-certified sophisticated investors” - COBS 4.12 Restrictions on the promotion of non-mainstream pooled investments - FCA Handbook

Estonian regulator has these - Information for entities engaging with virtual currencies and ICOs | FSA

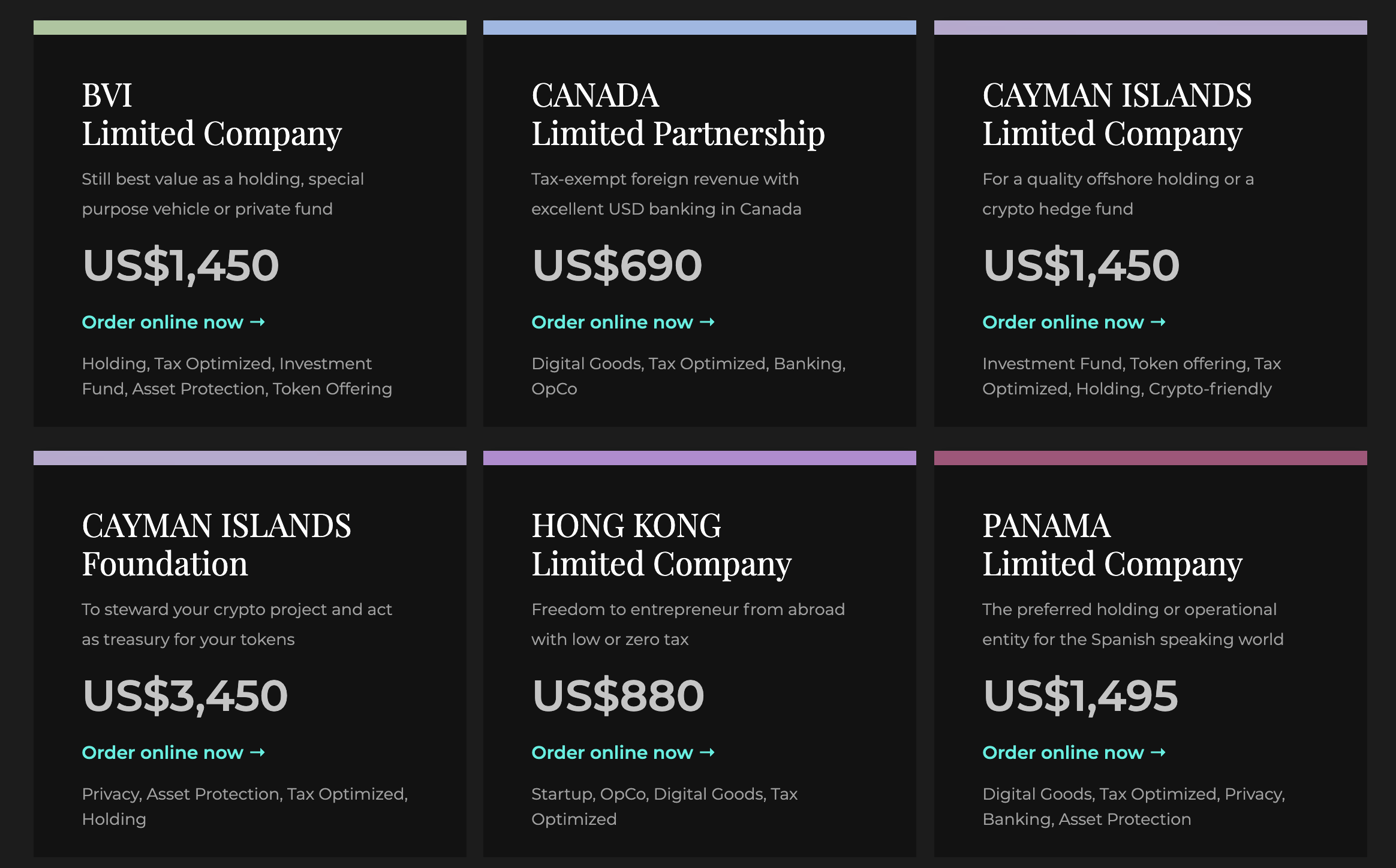

I am OK to route the ownership through any number of jurisdictions, ideally with 0% tax and no obligation of reporting, whatever gets closer to the goal - in my instance the goal is REGENERATIVE CIVILISATION

(choosing law just like you go to a restaurant to choose your lunch)

Hello, I can’t get too into it, but please don’t take any advice from that book or from it’s authors. This is not the cooperative route you’re looking for.

2 Likes

Hi all,

Mars forgot to make an intro.

I’m the person from BaseX that suggested using a co-operative legal structure.

I met Mars through the London Hackspace.

Mars introduced me to @astraliam and the AstralShip project, and he was acting as one of their funders.

The main aim of BaseX is to build a rural hackbase in Estonia.

Mars has been an advocate of using the Estonian model of E-Citizenship as a way of being able to work in the EU while being based in another country.

Estonia has by far the most highly-developed national ID card system in the world. Much more than a legal photo ID, the mandatory national card also provides digital access to all of Estonia’s secure e-services.

Est. reading time: 1 minute

1 Like

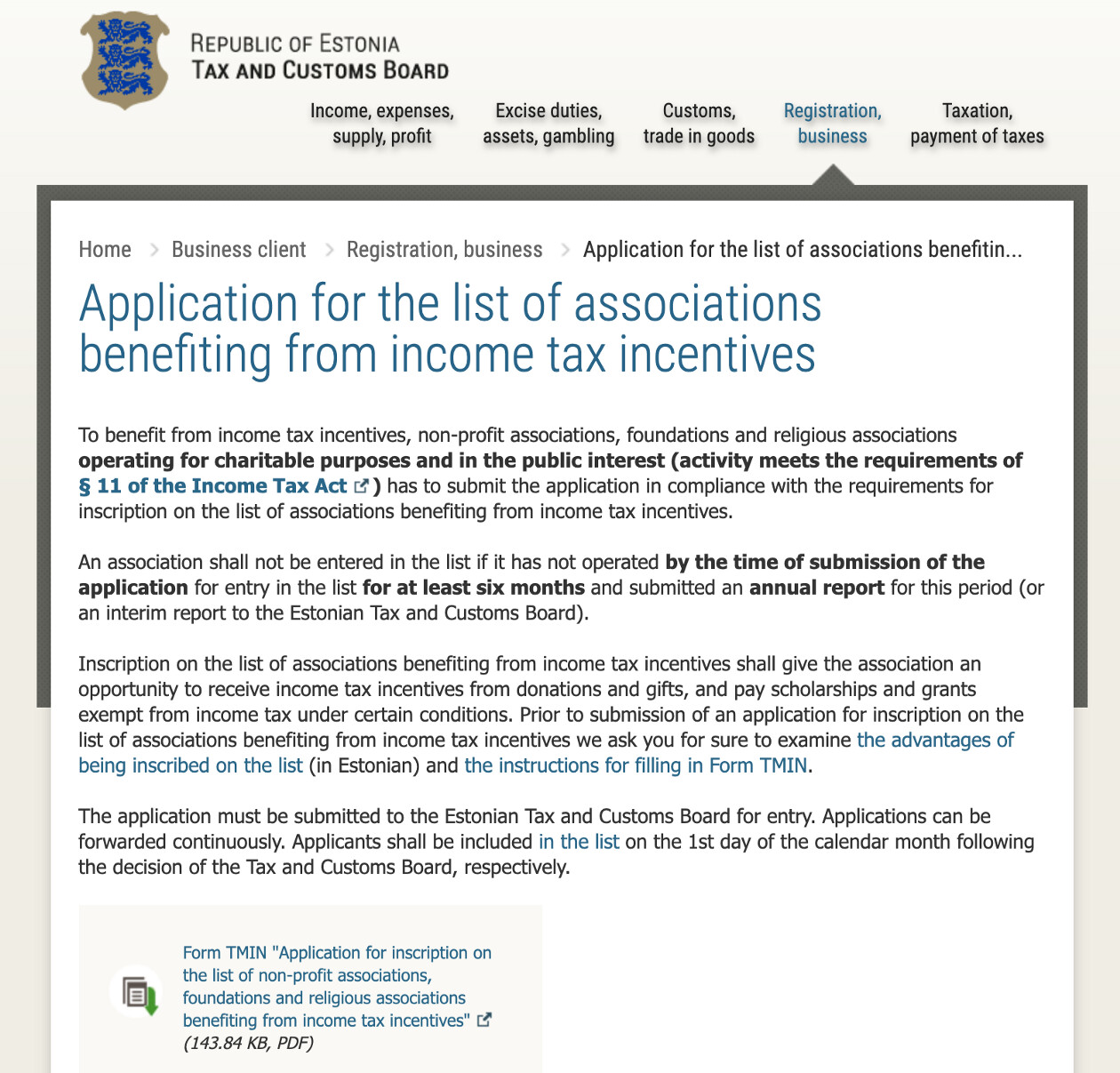

As you can see from the link in the above post, there is a mutual structure that is legally valid in Estonia, that can also act as an E-Citizen.

This structure is called an ühistu, or “Commerical Association”.

Provided that the Articles and Memorandum fullfill the Co-operative Principles, this means that anyone can start a co-op that is based in Estonia.

https://www.riigiteataja.ee/en/eli/520122017001/consolide

As Estonia is based in the Schengen Area, this would mean that a member of the ühistu would have the legal right to work in the EU, provided that all work was run through the ühistu.

It would also mean that the ühistu would be able to apply for any EU-based funding, so it would be a work-around for any co-operative that was previously using this type of funding.

4 Likes

mars

14 May 2021 18:33

7

I’m not clear: are you looking to establish a cooperative, or avoid tax? I’d argue that under the 7th principle, payment of tax is a desirable thing?

1 Like

mars

17 May 2021 10:47

9

To be clear - in this particular conversation - trying to be proactive:

There is a member in my community that is pushing towards co-op structure.

Someone says “do co-op” so I check what are the co-op options, cookie-cutter, copy-paste legal templates.

0% tax is pretty sweet deal.

In fact, I believe is the the only way to avoid tax avoidance.

No tax = no tax to avoid.

My previous work: E-Estonia Voluntary Tax P2P Personal Tokens UBI Blockchain DAO

Paradigm shift

What I really want to do:

Objective 1: Regenerative civilisation and climate change adaptation.

Objective 2: To acquire an island and create a living example serving Objective 1.

All the rest is reverse-engineering, working within the realm of the current legal system.

1 Like