Just curious who folk here bank with for business banking? I am with TSB at the moment but I keep encountering bugs in their systems (e.g. being redirected to a dev server URL) and it is making me quite uneasy.

Hi Pete, we bank with Co-operative Bank and have done for many years but it is a struggle, they tend to be a bit behind technically (currently our problem is that they have no bank feed compatible with FreeAgent) so we keep talking about changing but never do!

I would also suggest contacting your local Credit Union.

The LCCU in East London does Business Accounts, as well as personal accounts.

Your local one may do the same. ![]()

I’m tempted to merge this thread into this existing topic if that is OK with everybody:

We use Unity Trust, their web interface isn’t great (and it is run on a Windows server!), but it works… the key problem with Unity Trust is that they don’t issue debit cards.

I think the issue is that you either choose an ethical bank (such as Triodos) who don’t have all of the things you might need, or you choose a regular bank that have more of the things that you need from a service perspective. Basically: I don’t have a recommendation.

We used to use HSBC and they had the worst customer service I’ve ever encountered. They also blocked our access to our own bank account and we didn’t know if they’d closed it, where our money was, and when we were going to regain access. It was really stressful and put our business at risk.

Now we use Coop Bank whose UI is really bad. Sometimes I feel like I’m testing a half finished site because things are so difficult to find. It stopped supporting automatic feeds to Xero too, so we need to do it manually…but at least we can access our money.

Alan - thanks, I was thinking about Co-Op too but then I am in the same boat RE: banking feeds too ![]()

Bill - I hadn’t thought of that, good shout, thanks ![]()

Chris - merge is fine with me. No debit card is a bit of a dealbreaker for me unfortunately.

Winning selection for me would be:

- ethical

- have bank feeds / Open Banking

- provide debit cards

- have online statements

Totally agree with @Kayleigh

We used to use HSBC as Coop Bank were really unresponsive / unsupportive of a new business at the time when we needed to open an account asap as we had money coming in and nowhere to put it.

We always had good support from HSBC, but they never sat well with us so we switched to Unity Trust Bank a few years ago. The UI / UX is probably similar to Coop Bank (ie terrible), and they have also recently stopped automatic feeds into Xero due to the new regs. And we have to get Lloyds credit cards (no debt cards) for expenses etc - bloody Lloyds of all people!

We recently had to set up a Revolut for Business account to receive money from the World Bank (they couldn’t recognise UTB as a real bank so wouldn’t transfer funds). Our Finance Circle are going to consider offering Revolut cards instead of Lloyds credit cards, partly for ethical reasons (Revolut scores 10.5 on Ethical Consumer whereas Lloyds is 4.5) and partly because it will integrate much better with Xero and save us painful admin overhead.

Kayleigh, they did stop Xero/Co-op bank imports for a while, but it is possible again now. I had to fill in some form and scan it and upload to Xero IIRC, but now it’s fully automated and imports things into Xero without me having to do anything.

Thanks, that’s really helpful to know (although why didn’t they tell us?!)

As in the thread @chris may be about to merge, we still use Tide. Its okay. Some good bits. Very reliable Xero feed and responsive customer service. Solid UX. Good enough for the day to day.

However, only allowing one person the ability to access the bank account (though allowing multiple debit cards) is somewhat of a limitation, and we are minded to move on. Other challenger banks like Revolut or Monzo for Business look quite attractive.

Another shout for the good old Co-operative Bank - the only bank actually funding co-op development - well over £1m - and the only bank with a cooperative customer union! Just £12/year!

(Declaration of interest, I work for the Customer Union for Ethical Banking)

I was going to say that I’m looking forward to Nationwide launching their business accounts (imho they are the best for personal accounts, all things considered), but alas I’ve just read they’ve now scrapped those plans ![]()

+1 for the Co-op Bank. We’ve had our business account there for about 14 years or more, and it has never cost us a penny. They’ve just redone their online facility, it works. And as @shaun says they are the only bank that I know of that supports co-operative development.

Imagine if there was a cooperative bank who also had a best-in-class online banking experience! If only there were some cooperative technologists who could help ![]()

Thanks for the replies all. It is sound like it is going to be a toss-up between Co-op bank and Revolut for me.

Having just read the latest Ethical Consumer report on current accounts, United Diversity are going to be switching from Santander (we opened the account when they were still Abbey National building society) to Starling Bank.

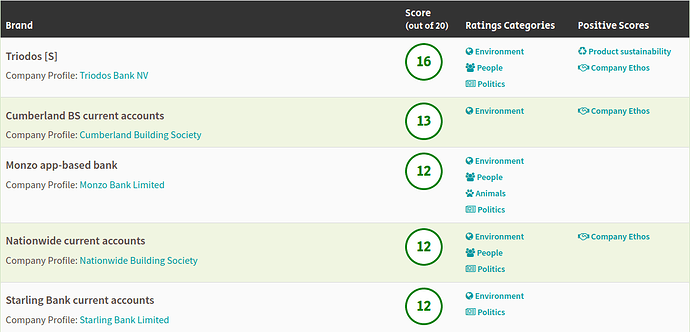

As you can see from the table above Triodos are the most ethical. But they charge for everything and don’t do debit cards (if I remember correctly).

Cumberland Building Society are the next best, but you can only open an account with them is you’re in Cumbria or South-West Scotland.

Starling Bank are rated joint 3rd place along with Nationwide and Monzo.

But Nationwide don’t do business accounts (they had some plans to do so, but they’ve now been scrapped ![]() ).

).

And whilst Monzo score the same on the table, in the text of the most recent Ethical Consumer report in their magazine they point out that:

Monzo is almost 25% owned by Passion Capital – jointly owned by Stefan Glaenzer, who pled guitly of sexual assault in 2012. (Monzo’s other major investor is owned by the brother of Jared Kushner, senior advisor and son-in-law to Donald Trump.)

When Ethical Consumer asked the app banks about ethics, “only Starling appeared to have any kind of ethical policy for it’s lending services” who said:

“We do not privde banking services to organisations that use excessive power to systemically promote public behaviour that is harmful to individuals, groups or to the whole of society in order to maximise their own profits. They may include, for example, arms manufactures and tobacco companies… We lend to UK-based individuals and small businesses and, as policy, don’t lent to companies involved in extracting fossil fuels”.

Ethical Consumer therefore conclude that:

“If you particularly want to switch to an app-only bank, Starling appears marginally more engaged than the others on ethical issues”.

Re Revolut, Ethical Consumer point out that they are not covered by the Financial Services Compensation Scheme (FSCS) so the first £85,000 that is covered by Monzo, Starling and all the other banks is not covered with Revolut.

Apparently Revolut has also been accused of mistreating workers during the pandemic. According to Ethical Consumer:

“Revolut employees say they have been forced to choose between quitting their jobs voluntarily for a small severance payment or being fired”

So, imho the best option at present is Starling, so that’s who we’re going to switch to.

Very small amendment to this – (I bank with them) they have branches in Lancaster and Preston so north Lancashire works as well.

Simon

I assume that’s a reference to Cumberland building society, thanks. I was just relaying what they told me on the phone (I had to call them as their website didn’t make it obviously clear and their web chat thing didn’t seem to actually work. Sigh).

I couldn’t recommend Starling bank highly enough!

Incredible user experience, the business toolkit makes everything so simple with invoicing, VAT etc.

Best of all is there customer service. If you would like a feature adding to the app or find a problem, just pop them a message in the app and they get back to you very quickly.

Very customer orientated.

Hi, at Data Content Reach we’ve just formed (hi!) and ended up using Starling too.

That was based on:

-

Ethical Consumer’s rankings (we do a lot of work with ECRA and are current / former directors) as per Josef’s screengrab - Ethical Business Banking | Ethical Consumer (paywalled but they are a worker co-op, and worth a £30 subscription)

-

Ease and speed of the application process

-

Interface and integrations

-

Despite using the Coop Bank-funded CoopsUK formation process, it being difficult to get any answers from the Coop about anything (I use them for my other business and they are ok so long as you don’t need any flexibility or quick answers and don’t mind the new but somehow equally terrible online interface)

I’m not super happy about a phone-based banking app, and the online login for me is a bit iffy as my phone camera doesn’t seem to handle their QR code very well) but so far the experience has been pretty good.

They have ethical downsides though -

"Starling Bank, for example, has some good statements on avoiding investment in certain industries such as fossil fuels and arms manufacture. But its environmental reporting and transparency commitment is not comprehensive.

The Starling website also names its leading financial backers as Harald McPike, reported to be a “secretive Bahamas-based investor”, and Merian Global Investors. Merian was recently acquired by Jupiter Fund Management PLC, a company that receives our worst rating for likely use of tax avoidance strategies. With Starling’s sights set on rapid growth and an initial public offering in the coming years, it will have to work hard to not let its first ethical steps be diluted by the world of unethical finance."